oklahoma franchise tax online filing

Oklahoma franchise excise tax is levied and assessed at the rate of 125 per 100000 or fraction thereof on the amount of capital allocated or employed in oklahoma. Our Mission is to serve the people of Oklahoma by promoting tax compliance through quality service and fair.

Living On One Income Taking Action Accounting Firms Budgeting Money Management

Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200.

. These elections must be made by July 1. Franchise Tax Computation The basis for computing Oklahoma Franchise Tax is the balance sheet as shown by your books of account at the close of the last preceding. Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now.

Select Popular Legal Forms Packages of Any Category. When is franchise tax due. You may file this form online or download it at taxokgov.

Online Filing Oklahoma Taxpayer Access Point OkTAP makes it easy to file and pay. Tax year the tax will be due and. Online Filing - Individuals Use Tax - Individual E-File Income CARS Sales Use Rate Locator Payment Options Tax Professionals.

Go to the Oklahoma Taxpayer Access Point OkTAP login page. The following is the Tax Commissions mission statement as it exemplifies our direction and focus. Complete OTC Form 200-F.

Form 200-F must be filed no later than July 1. Online Filing - Individuals Use Tax - Individual E-File Income CARS Sales Use Rate Locator Payment Options Tax Professionals. File the annual franchise tax using the same period and due date of their corporate income tax filing year or File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512 or 512-S.

Get Instant Recommendations Trusted Reviews. If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then combined for one total tax. With the reorganization of the Oklahoma Tax Commission in 1995 came the refocus of the Tax Commissions goals and objectives.

To file your annual franchise tax online. You can create an account by clicking Register here To file your Annual Franchise Tax by Mail. Your session has expired.

You can change your filing date by filing Form 200-F Request to Change Franchise Tax Filing Period by mail or online using OkTAP Oklahomas online filing system by July 1st. With 100 Accuracy Guaranteed. However the IRS and the respective State Tax Agencies require you to e-file a Federal Income Tax Return at the same time you e-file a State Tax Return.

On the Oklahoma Tax Commission website go to the Business Forms page. Oklahoma franchise tax is due and payable each year on July 1. You will need to specify one tax account type for.

When a corporations franchise tax liability is zero the corporation must still file an annual franchise tax return. The report and tax will be delinquent if not paid on or before August 31 and. Your browser appears to have cookies disabled.

You will be automatically redirected to the home page or you may click below to return immediately. While we are available Monday through Friday 8 am-5 pm. After you have filed the request to change your filing period you will not need to file this form again.

The Comptrollers office has amended Rule. These elections must be made by July 1. Changes to Franchise Tax Nexus.

For a corporation that has elected to change its filing period to match its fiscal year the franchise tax is due on the 15th day of the third month following the close of the corporations tax year. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Compare the Top Online Tax Filing and Find the One Thats Best for You.

Corporations that remitted the maximum amount of franchise tax for the. Access can be added to additional accounts through OkTAP after you have registered. Central Time shorter wait times normally occur from 8-10 am.

All Major Categories Covered. To file your Annual Franchise Tax Online. Oklahoma franchise excise tax is levied and assessed at the rate of 125 per 100000 or fraction thereof on the amount of capital allocated or employed in Oklahoma.

Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma. Nexus for franchise tax reports due on or after Jan. We would like to show you a description here but the site wont allow us.

You will need to specify one tax account type for OkTAP access at the time of registration. If a foreign corporation one domiciled. 31 2021 can be e-Filed together with the IRS Income.

For additional information see our Call Tips and Peak Schedule webpage. Please have your 11-digit taxpayer number ready when you call. To make this election file Form 200-F.

Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. To register as a new OkTAP user click the Register Now button on the top right of the OkTAP homepage and complete the required fields. Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now.

Ad See the Top 10 Online Tax Filing. This form is used to notify the Oklahoma Tax Commission that the below named corporation is electing to. For purposes of filing 2013 franchise tax return all corporations are considered fiscal-year filers.

Complete Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax to determine the combined taxable income to report on page 2 Section Two lines 1825. Request to Change Franchise Tax Filing Period. If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then combined for one total tax.

These elections must be made by July 1. Cookies are required to use this site. Enter your username and password.

Oklahoma must file an annual franchise tax return and pay the franchise tax by July 1 of each year. Scroll down the page until you find Oklahoma Annual Franchise.

Get 50 Cash In A Flash 875 E Semoran Blvd Apopka Fl 32703 Liberty Tax Tax Services Tax

Does Your Business Need To Pay A Franchise Tax Bench Accounting

When Are Taxes Due For Businesses Legalzoom Com

Pin By Ca Gulshan Sharma On Legal Services Goods And Service Tax Legal Services Registration

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

Pin Em Veaytү Vℓsggeyas ғʀᴇsʜ ғᴀsʜɪᴏɴɪsᴛᴀs

A Personal Favorite From My Etsy Shop Https Www Etsy Com Listing 593633046 Mugs With Sayings I Dont White Coffee Mugs Buy Coffee Beans Best Travel Coffee Mug

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Everything You Need To Know About Netfile H R Block Canada

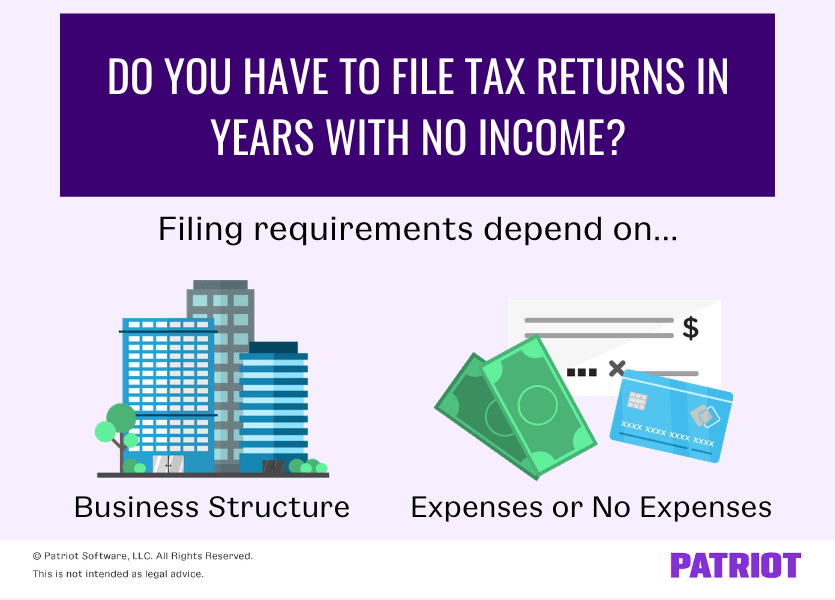

Filing Taxes For Small Business With No Income Requirements

H R Block Tax Calculator Services

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Filing Taxes For Small Business With No Income Requirements

Franchise Tax What Is It Fundsnet

How Much To Set Aside For Small Business Taxes Bench Accounting

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition